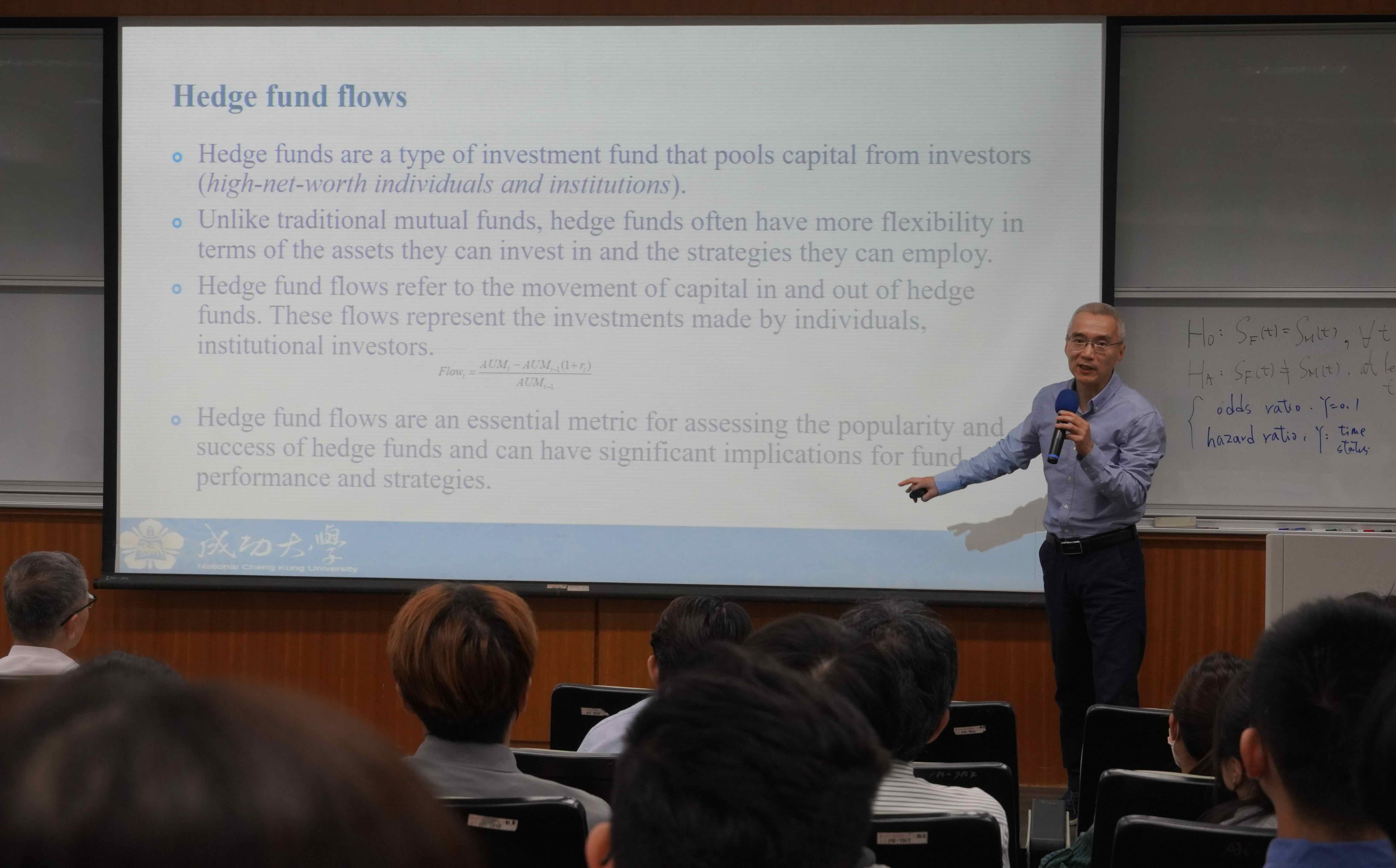

【專題演講】112/11/30(四) 15:30-16:30 Dr. Leilei Tang(唐镭镭 博士)

Abstract

This paper explores the impact of fund flows on hedge fund liquidation risk. The identification of fund flows, however, may not be clearly discerned due to potential reverse causality. We use exogenous shocks caused by the mutual fund scandal associated with Lehman Brothers Holding in 2003 and its collapse in 2008 to address the endogeneity issue. We show that a 1 percent increase in unexpected fund flows measured by Lehman induced events produces 0.328 percent increase in the hazard for liquidation. We finally contrast the forecasting accuracy of a hazard model including directly observable information with that accounts for indirectly observable information. An out-of-sample comparison shows that the enhanced model outperforms the base model in correctly identifying liquidated funds.